In these times of trading down and switching, brands are changing their product mixes to meet the changing needs of their customers. In the UK, the major grocers continue to extend their range of private-label brands (many of which are discount brands), and even the up-market grocers are introducing value ranges.

This creates a new set of issues that well-established brands are able to capitalize on: the elimination of risk. A risk that arises out of doubt; a consumer’s questioning whether or not a switch will satisfy their current wants and needs. At the point of purchase, consumers are likely to weigh the obvious saving benefits against the preference of their current brand. Asking themselves things like “Will my family like it as much? Will it last as long? Will it work as well?”

According to Dave Lewis, Chairman of Unilever in the UK, who spoke at last week’s Retail Week Conference in London, share of retailer private-label laundry detergent has remained flat over the last year, while there was growth of over 20% in Unilever’s value brand, Surf. His conclusion was that shoppers are prepared to trade down but not to risk trying products that might not work.

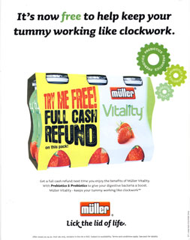

There are some interesting ways that brands are responding to the competition of private-label brands and this era of risk aversion. I came across this interesting offer by Muller Vitality, who eliminates this risk by offering to reimburse the price of their product. For a relatively new product, offers like these can help ease consumer doubt, potentially increasing trial, and converting new users. It is certainly a way to ensure that a new product secures all important distribution.

UK supermarket Sainsbury’s current TV advertising taps directly into this sentiment, making reference to the fact that dad “might not like it”, with plenty of evidence from his kids that he probably will.

In our own research with UK shoppers, we found that large numbers were prepared to try retailer private labels, but if they don’t live up to the standards of their current brands, this could backfire on retailers.

-Contributed by Ian Thomas